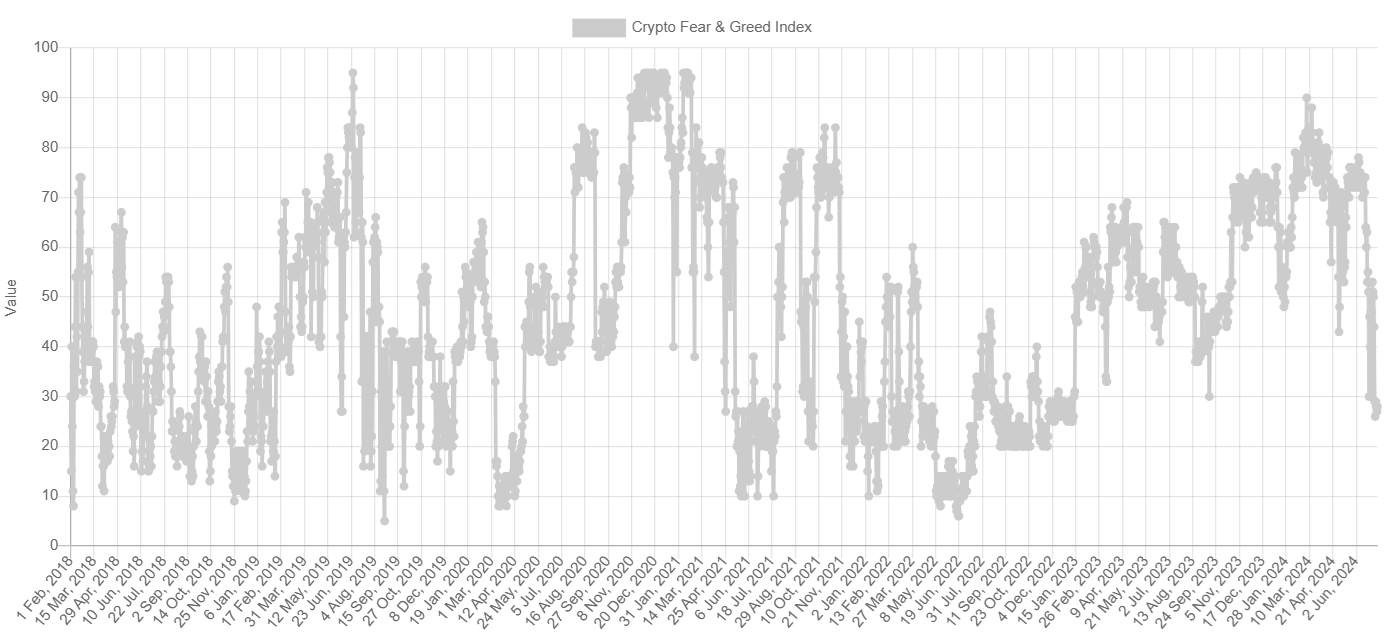

There are several old adages on Wall Street that teach buying when the masses are panicking. Investors should be taking their advice today… Bitcoin (BTC-USD) rallied to all-time highs above $73,000 in March – pushing the Crypto Fear & Greed Index to a “severe greed” reading at 90. Today, the coin is trading at $57,000 and the index is down to a “severe fear” reading of 26. That’s a level it hasn’t seen since 2023 when Bitcoin was worth just $17,000.

On today’s new episode of the SteadyTrade Podcast, Tim Bohen and Matt McCall discuss in detail why Bitcoin has fallen from all-time highs into a bear market.

The good news is that they expect it may be short-lived…

Several potential catalysts on the horizon could send Bitcoin and the broad crypto market higher – including interest rate cuts at the September Federal Reserve meeting, a Trump win in the presidential election, and an SEC approval of an Ethereum (ETH-USD) spot exchange-traded fund (ETF). These catalysts combined with extreme fear levels indicate that now could be the right time to start adding exposure to this asset class.

So what’s our plan?

Click here to watch the latest episode of the SteadyTrade Podcast and find out.